Every day, millions of Americans stand at store checkout counters and make a seemingly random decision: after swiping their debit card, they choose whether to punch in a code, or to sign their name.

Every day, millions of Americans stand at store checkout counters and make a seemingly random decision: after swiping their debit card, they choose whether to punch in a code, or to sign their name.It is a pointless distinction to most consumers, since the price is the same either way. But behind the scenes, billions of dollars are at stake.

When you sign a debit card receipt at a large retailer, the store pays your bank an average of 75 cents for every $100 spent, more than twice as much as when you punch in a four-digit code.

The difference is so large that Costco will not allow you to sign for your debit purchase in its checkout lines. Wal-Mart and Home Depot steer customers to use a PIN, the debit card norm outside the United States.

Despite all this, signature debit cards dominate debit use in this country, accounting for 61 percent of all such transactions, even though PIN debit cards are less expensive and less vulnerable to fraud.

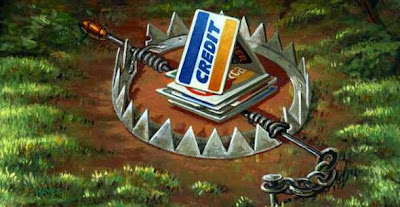

How this came to be is largely a result of a successful if controversial strategy hatched decades ago by Visa, the dominant payment network for credit and debit cards. It is an approach that has benefited Visa and the nation’s banks at the expense of merchants and, some argue, consumers.

Competition, of course, usually forces prices lower. But for payment networks like Visa and MasterCard, competition in the card business is more about winning over banks that actually issue the cards than consumers who use them. Visa and MasterCard set the fees that merchants must pay the cardholder’s bank. And higher fees mean higher profits for banks, even if it means that merchants shift the cost to consumers.

Seizing on this odd twist, Visa enticed banks to embrace signature debit — the higher-priced method of handling debit cards — and turned over the fees to banks as an incentive to issue more Visa cards. At least initially, MasterCard and other rivals promoted PIN debit instead.

As debit cards became the preferred plastic in American wallets, Visa has turned its attention to PIN debit too and increased its market share even more. And it has succeeded — not by lowering the fees that merchants pay, but often by pushing them up, making its bank customers happier.

In an effort to catch up, MasterCard and other rivals eventually raised fees on debit cards too, sometimes higher than Visa, to try to woo bank customers back.

“What we witnessed was truly a perverse form of competition,” said Ronald Congemi, the former chief executive of Star Systems, one of the regional PIN-based networks that has struggled to compete with Visa. “They competed on the basis of raising prices. What other industry do you know that gets away with that?”

Visa has managed to dominate the debit landscape despite more than a decade of litigation and antitrust investigations into high fees and anticompetitive behavior, including a settlement in 2003 in which Visa paid $2 billion that some predicted would inject more competition into the debit industry.

Yet today, Visa has a commanding lead in signature debit in the United States, with a 73 percent share. Its share of the domestic PIN debit market is smaller but growing, at 42 percent, making Visa the biggest PIN network, according to The Nilson Report, an industry newsletter.

The Risk of Refusing

Critics complain that Visa does not fight fair, and that it used its market power to force merchants to accept higher costs for debit cards. Merchants say they cannot refuse Visa cards because it would result in lower sales.

“A dollar is no longer a dollar in this country,” said Mallory Duncan, senior vice president of the National Retail Federation, a trade association. “It’s a Visa dollar. It’s only worth 99 cents because they take a piece of every one.”

Visa officials say its critics are griping about debit products that have transformed the nation’s payment system, adding convenience for consumers and higher sales for merchants, while cutting the hassle and expense of dealing with cash and checks. In recent years, New York cabbies and McDonald’s restaurants are among those reporting higher sales as a result of accepting plastic.

“At times we have a perspective problem,” said William M. Sheedy, Visa’s president for the Americas. “Debit has become so mainstream, some of the people who have benefited have lost sight of what their business model was, what their cost structure was.”

Visa officials said the costs of debit for merchants had not gone down because the cards now provided greater value than they did five or 10 years ago. The costs must not be too onerous, they say, because merchant acceptance has doubled in the last decade.

The fees are “not a cost-based calculation, but a value-based calculation,” said Elizabeth Buse, Visa’s global head of product.

As for Visa’s market share, company officials maintain that it is rather small when considered within the larger context of all payments, where, for now at least, cash remains king.

While Visa may be among the best-known brands in the world, how it operates is a mystery to many consumers.

Visa does not distribute credit or debit cards, nor does it provide credit so consumers can buy flat-screen televisions or a Starbucks latte. Those tasks are left to the banks, which owned Visa until it went public in 2008.

Continue Reading over at NYTimes.comDid you like this post? Leave your comments below!Found this Post interesting? Receive new posts via RSS (What is RSS?) or Subscribe to CR by Email